In an earlier MindLink article we evaluated transfer pricing (TP) challenges facing distributors in multinational groups and the scope for using Berry ratios in assessing whether the value of a controlled transaction is arm’s length. In this article we look at a practical example of how Berry ratios can be used, as well as discussing requirements and conditions you need to consider when it comes to segmenting your financial data.

First off, let us figure out where the Berry ratio comes into play to defend fees charged in your related-party transactions. According to the OECD guidelines (January 2022 version) and the UN transfer pricing manual, the following criteria should be met:

1) The value of functions performed, which is created in a controlled transaction, is proportional to operating costs.

2) The value of goods being distributed doesn’t significantly affect the value of functions performed, meaning it’s not proportional to sales volumes.

3) As part of the controlled transaction being analysed, the taxpayer performs no other significant function (such as production) to be remunerated using another TP method or financial indicator.

Let us now take a look at how the Berry ratio can be applied to a Latvian wholesaler for TP purposes.

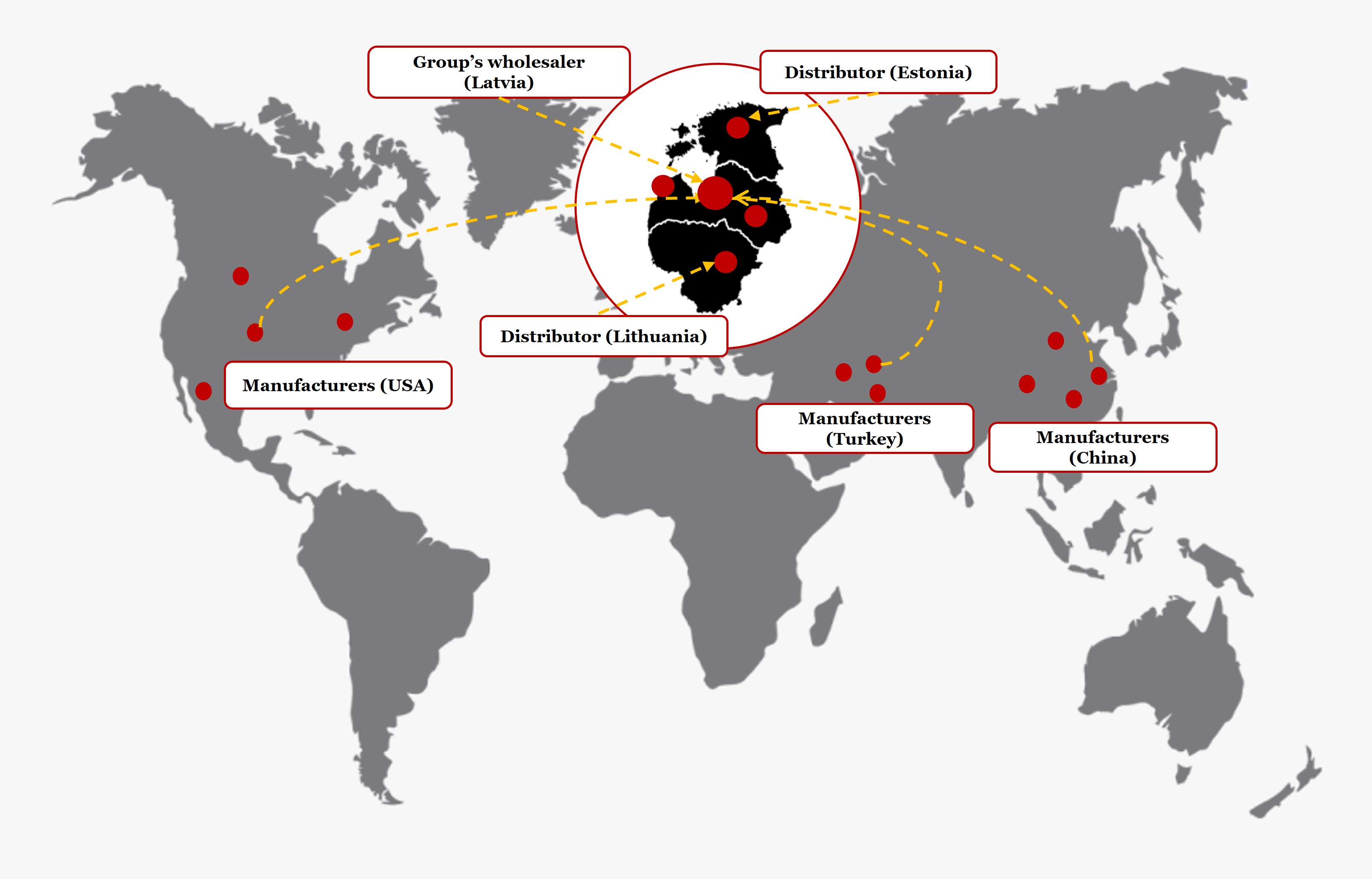

A Latvian-registered wholesaler (Company A) sells goods manufactured by other group companies to unrelated distributors on the local market. The company buys goods from the group’s related manufacturers in the US, Turkey and China.

Based on Company A’s geographical location, a strategic decision was made for it to make centralised purchases in the Baltic States and sell the goods on to related companies in Estonia and Lithuania, thereby easing the administrative burden of the related companies concerned (i.e. the group manufacturers as well as Lithuanian and Estonian wholesalers).

Figure 1. The group’s geographical location

Table 1 shows Company A’s profit and loss (P&L) account for the financial year 2022:

Table 1 shows Company A’s profit and loss (P&L) account for the financial year 2022:

Table 1

|

|

2022 (EUR) |

|

Net revenue (1) |

100,000 |

|

Cost of goods sold |

(61,500) |

|

Gross profit |

38,500 |

|

Selling costs |

(17,000) |

|

Administration costs, incl. |

(11,500) |

|

management services from group HQ |

(4,500) |

|

Other operating costs |

(2,000) |

|

Operating profit (2) |

8,000 |

|

Net margin (2/1) |

8.00% |

First off, a financial data segmentation was carried out to determine whether the price (value) set for Company A’s controlled transaction type is arm’s length.

The overall P&L financial data doesn’t give a full picture of how profitable Company A’s related-party transaction type is, so we need to separate the segment of sales to unrelated customers on the local market and the segment of sales to related companies in Lithuania and Estonia:

Table 2. Segmented financial data

|

Indicator |

Fin stats |

Sales to: |

||||

|

unrelated parties |

related foreign companies |

|||||

|

A Ltd |

B Ltd |

C Ltd |

LT |

EE |

||

|

Net revenue (1) |

100,000 |

21,000 |

38,500 |

10,500 |

20,000 |

10,000 |

|

Cost of goods sold |

(61,500) |

(12,250) |

(23,500) |

(6,000) |

(13,050) |

(6,700) |

|

Gross profit (3) |

38,500 |

8,750 |

15,000 |

4,500 |

6,950 |

3,300 |

|

Selling costs |

(17,000) |

(3,570) |

(6,545) |

(1,785) |

(3,400) |

(1,700) |

|

Administration costs, incl. |

(11,500) |

(2,820) |

(5,170) |

(1,410) |

(1,400) |

(700) |

|

management services from group HQ |

(4,500) |

(1,350) |

(2,475) |

(675) |

- |

- |

|

Other operating costs |

(2,000) |

(420) |

(770) |

(210) |

(400) |

(200) |

|

Operating profit (2) |

8,000 |

1,940 |

2,515 |

1,095 |

1,750 |

700 |

|

Operating cost (4) |

(30,500) |

(6,810) |

(12,485) |

(3,405) |

(5,200) |

(2,600) |

|

Profit margin (2/1) |

8.00% |

9.24% |

6.53% |

10.43% |

8.75% |

7.00% |

|

Berry ratio (3/4) |

|

|

|

|

1.34 |

1.27 |

It’s important to note that any other controlled costs that are capable of affecting the result (such as group management service fees or royalties for group licences) should be separated from operating costs in the Berry ratio calculation. So this segmentation of financial data involved placing management service fees in the segment of sales to unrelated parties.

The segmentation shows that Company A achieves Berry ratios of 1.34 and 1.27 in this controlled transaction type of selling goods bought from group manufacturers to related companies in Lithuania and Estonia.

A benchmarking study was also conducted to make sure the value of the controlled transaction type (i.e. the Berry ratio) is arm’s length. Table 3 summarises the results of benchmarking analysis:

Table 3. The arm’s length range of Berry ratios for 2022

|

Arm’s length range |

Berry ratio 2022 |

|

Minimum value |

0.76 |

|

Bottom quartile |

1.03 |

|

Median |

1.34 |

|

Top quartile |

1.68 |

|

Maximum value |

2.47 |

|

Number of comparable companies |

6 |

A comparison of Company A’s segmented financials with the arm’s length range of Berry ratios shows that the Berry ratio for the transaction with Lithuanian and Estonian related companies is arm’s length.

Using the Berry ratio for TP purposes tends to be a more appropriate and reliable approach for multinational group wholesalers whose revenues and costs are affected by controlled purchases and sales. Yet this might raise the question of whether financial data is available at gross level. What we see in practice is that gross-level financial data is available from commercial databases on Latvian and Lithuanian companies, so it’s possible to select comparable companies and make reliable Berry ratio calculations.

It’s also worth mentioning that our evaluation of published court cases dealing with multinational TP issues has discovered a lack of case law on misuse of the Berry ratio for TP purposes. So, based on reliable analysis, using the Berry ratio poses no significant risks to taxpayers.

If you have any comments on this article please email them to lv_mindlink@pwc.com

Ask questionIn our previous articles we discussed the transfer pricing (TP) aspects of guarantees and looked at methods that can be used to arrive at an arm’s length price. We will close out this series of articles with key insights from international case law and compare how the tax authorities treat the validation of guarantee transactions in a TP file.

Our experience suggests that intragroup services represent the most common centralised activities in a multinational enterprise (MNE) group and they are also transactions being scrutinised by the tax authority.

This statement does not seem to make sense and is contrary to what the law says about capital gains tax being payable only on income that results from a disposal of real estate (RE). However, a certain taxpayer had to fight in court for his right to be exempt from a tax liability on an RE disposal.

We use cookies to make our site work well for you and so we can continually improve it. The cookies that keep the site functioning are always on. We use analytics and marketing cookies to help us understand what content is of most interest and to personalise your user experience.

It’s your choice to accept these or not. You can either click the 'I accept all’ button below or use the switches to choose and save your choices.

For detailed information on how we use cookies and other tracking technologies, please visit our cookies information page.

These cookies are necessary for the website to operate. Our website cannot function without these cookies and they can only be disabled by changing your browser preferences.

These cookies allow us to measure and report on website activity by tracking page visits, visitor locations and how visitors move around the site. The information collected does not directly identify visitors. We drop these cookies and use Adobe to help us analyse the data.

These cookies help us provide you with personalised and relevant services or advertising, and track the effectiveness of our digital marketing activities.