As the tax system evolves, the regulatory authorities have been rearranging their priorities around transfer pricing risks and focusing on increasingly complex cases in recent years. The transfer pricing aspects of intangible assets are climbing up the agenda, so we will be posting a few articles to explain the significance of related-party transactions involving the use of intangibles, as well as looking at transfer pricing trends, common risks, and relevant case law.

An intangible is an asset the company owns or controls that has these characteristics:

It is important to note that intangibles for transfer pricing purposes are not always recorded as such in the company’s books. Costs associated with in-house development of intangibles (e.g. R&D and advertising) are sometimes posted as expenses, rather than being capitalised in the books. So intangibles arising from such expenses do not always appear on the balance sheet. Yet those assets can be used for creating a considerable economic value and should be taken into account for transfer pricing purposes.

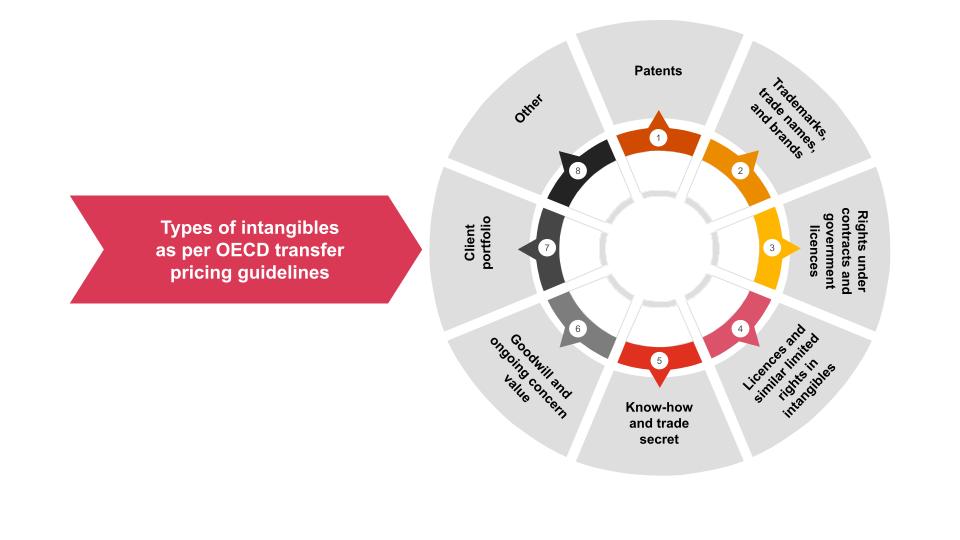

The OECD’s transfer pricing guidelines specify the types of intangibles that are subject to transfer pricing. The picture below shows the main types:

There may be two types of transactions with intangibles once they are split off:

The transfer pricing risks associated with intangibles can be grouped into three main categories:

The main corollary of tax risks associated with intangibles is that licences or other types of payments are used for shifting profits to a jurisdiction with a more generous tax regime or lower rates.

Tax advantages are achieved by having the tax base reduced at the payer’s end by deducting licences or other payments associated with intangibles. The payee, in turn, achieves a tax saving from lower tax rates or a special regime.

In our upcoming articles we will be exploring the concept of “hard-to-value intangibles” and the case law relating to intangibles in general.

If you have any comments on this article please email them to lv_mindlink@pwc.com

Ask questionThe legal form, meaning the contract between related parties and its provisions, has always been among the factors that come into play when assessing whether prices applied in controlled transactions are arm’s length. This article discusses why the legal form of a transaction is important, looks at a common approach to preparing intragroup contracts, and explores some rules that should be followed when drafting those contracts to mitigate transfer pricing risks.

Section 15.2 of the Taxes and Duties Act requires a taxpayer to meet requirements for the timeliness of information included in their transfer pricing (“TP”) documentation and for regular updates to reflect the present situation. During a period of calm in preparing and filing TP documentation, we asked the State Revenue Service (“SRS”) to answer some confusing questions about updating comparable data and revising financial data, including the scope for taking the roll forward approach.

When doing a transfer pricing analysis of financial transactions, we need to assess the borrower’s creditworthiness before setting an interest rate. To evaluate the risk associated with an intragroup financial transaction and determine an arm’s length interest rate for taking credit risk, the lender should evaluate the likelihood of the borrower defaulting, i.e. creditworthiness, and the probability of recovering the loan. This article explores a credit rating model that multinational enterprises often create to determine the creditworthiness of particular units.

We use cookies to make our site work well for you and so we can continually improve it. The cookies that keep the site functioning are always on. We use analytics and marketing cookies to help us understand what content is of most interest and to personalise your user experience.

It’s your choice to accept these or not. You can either click the 'I accept all’ button below or use the switches to choose and save your choices.

For detailed information on how we use cookies and other tracking technologies, please visit our cookies information page.

These cookies are necessary for the website to operate. Our website cannot function without these cookies and they can only be disabled by changing your browser preferences.

These cookies allow us to measure and report on website activity by tracking page visits, visitor locations and how visitors move around the site. The information collected does not directly identify visitors. We drop these cookies and use Adobe to help us analyse the data.

These cookies help us provide you with personalised and relevant services or advertising, and track the effectiveness of our digital marketing activities.