In the modern age of large corporations, the business value chain, which usually comprises a range of functions such as devising and implementing a business strategy, research and development, production, marketing, sales and logistics, spans a number of group companies operating in different countries. This apportionment is based on business needs and national rules for permanent establishments. Since an enterprise group involves multiple companies, they conduct intragroup transactions and charge transfer prices, giving rise to tax risks.

The number one burning question globally is how to fairly allocate a group’s total profits between the countries where it operates to give each of those countries an opportunity to charge income tax on the part of profits that is due to it. So transfer pricing reviews typically focus on corporate profits. A group restructuring, on the other hand, usually changes functions the companies perform within the group as well as their fees, so that the group’s profits are reapportioned between the companies and the countries, which tends to pose transfer pricing risks.

Key transfer pricing risks in a group restructuring are as follows:

Accordingly, if a company is involved in a group restructuring there are four basic questions we should answer to assess potential transfer pricing risks:

Let us take a look at an example of international case law – the Piaggio restructuring case of 2007, which did not have a court ruling announced until 2020.

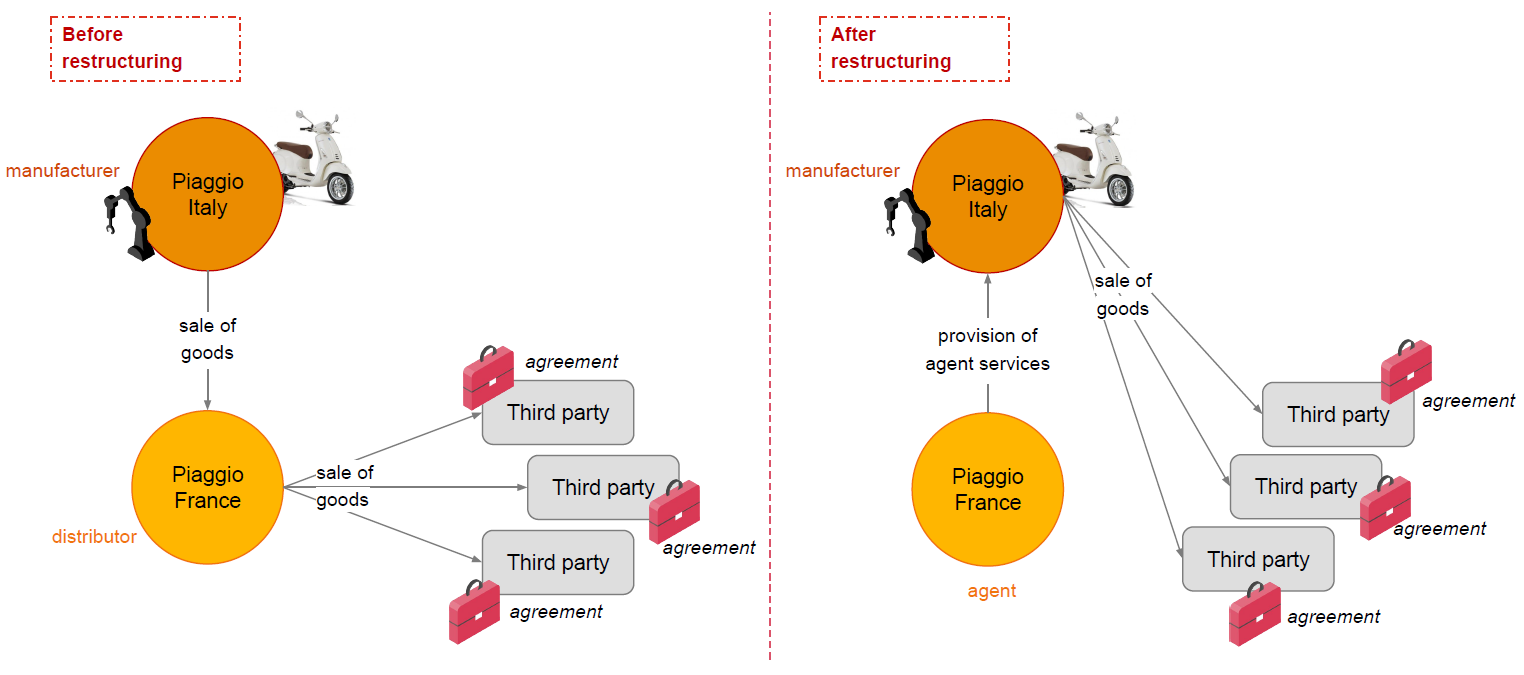

Piaggio is an Italian group of companies that manufactures and sells scooters and motorcycles. In France it has SAS Piaggio France, a company that helps the group distribute its goods in France. Before 2007 SAS Piaggio France was the group’s official wholesale representative in France, with a revenue of EUR 87 million. In 2007 the group decided to undertake a restructuring and converted SAS Piaggio France into a sales agent. Before 2007 the company purchased goods from the parent company in Italia and sold on to unrelated customers, keeping a profit from the sales according to the wholesale function. After converting the company into an agent, the group had the sales contracts with its French dealers resigned to the Italian parent company, while SAS Piaggio France received a small fee for helping organise sales. So the company’s annual revenue dropped from EUR 87 million to EUR 6 million.

This situation is quite common if a group wants to minimise its total tax burden because the conversion of wholesalers into sales agents is able to substantially cut the company’s profits and tax liability. While groups are not banned from doing this we need to remember the four key questions for assessing transfer pricing risk.

So the first question the tax authority will ask during a tax audit of the restructuring would be: What has really changed? If the company’s fee is to be reduced so drastically there must be some real changes made in the company as well as to its staff count and functions. If the company’s business shows no substantial change the tax authority will find it easy to challenge the new fee-setting approach and to assess lost profits.

In the case of SAS Piaggio France the French tax authority detected changes but the questions they asked were different. Did the restructuring result in some functions, risks or assets being transferred? And should a fee be received for the transfer? The changes to the way Piaggio’s French and Italian companies did business resulted in all the business contracts with SAS Piaggio France customers being resigned to the group’s Italian company. So the French tax authority found that the restructuring resulted in SAS Piaggio France transferring not only the wholesale function but also an intangible asset – its customer base – and the associated potential profits to its related Italian company free of charge. So the French tax authority assessed close to EUR 8 million of income SAS Piaggio France had lost.

First, we need to find out whether the restructuring is likely to bring about a reduction in the company’s profits. Such a situation will nearly always lead to the conclusion that the company should have received an additional fee for the functions, risks or assets transferred as a result of the restructuring. The market value of a function, risk or intangible asset can be calculated by enlisting the help of valuation experts who can estimate a fee based on past financial performance and on the company’s forecasts for the future development of this line of business.

Second, any company that plans to take part in a group restructuring should find out whether the group has carried out an in-depth transfer pricing analysis to mitigate potential tax risks. If those risks are substantial, approval for the proposed reorganisation should be sought from the tax authority before it is implemented.

If you have any comments on this article please email them to lv_mindlink@pwc.com

Ask questionWe use cookies to make our site work well for you and so we can continually improve it. The cookies that keep the site functioning are always on. We use analytics and marketing cookies to help us understand what content is of most interest and to personalise your user experience.

It’s your choice to accept these or not. You can either click the 'I accept all’ button below or use the switches to choose and save your choices.

For detailed information on how we use cookies and other tracking technologies, please visit our cookies information page.

These cookies are necessary for the website to operate. Our website cannot function without these cookies and they can only be disabled by changing your browser preferences.

These cookies allow us to measure and report on website activity by tracking page visits, visitor locations and how visitors move around the site. The information collected does not directly identify visitors. We drop these cookies and use Adobe to help us analyse the data.

These cookies help us provide you with personalised and relevant services or advertising, and track the effectiveness of our digital marketing activities.