On 11 February 2020 the OECD published the final version of its transfer pricing (“TP”) guidelines for financing transactions, a document welcomed also by Latvian taxpayers within multinational enterprise groups, by tax consulting service providers, and by the State Revenue Service. We wrote several articles about the draft guidelines in 2018 (21.09.2018), (12.10.2018), so this series of articles will explore some of the changes arising from the final version. We will also look at some global trends and key aspects to be considered in analysing financing transactions according to the OECD recommendations.

Identifying financing transactions according to the OECD TP guidelines

The OECD’s guidelines on the TP treatment of financing transactions emphasise the need to correctly define a financing transaction and underlines the effect of that definition on the prices applied in the transaction. Before determining an appropriate price (value) for a proposed financing transaction between related parties, we need to clearly define the transaction, its substance, purpose and conditions, as well as determining whether it substantially meets the criteria for a financing transaction.

Let us now look at some major changes or some criteria in the final version that were emphasised again compared with the draft:

- Arm’s length amount of loan. The guidelines emphasise that in assessing whether a controlled financing transaction is consistent with a comparable transaction between unrelated parties, it is important to analyse not only the interest rates applied in the transaction but also the amount lent/borrowed. Compared with the draft, the final version again emphasises the link with article 9 of the 2017 Model Tax Convention and commentary. Our previous series of articles described how to analyse the arm’s length amount of a financing transaction.

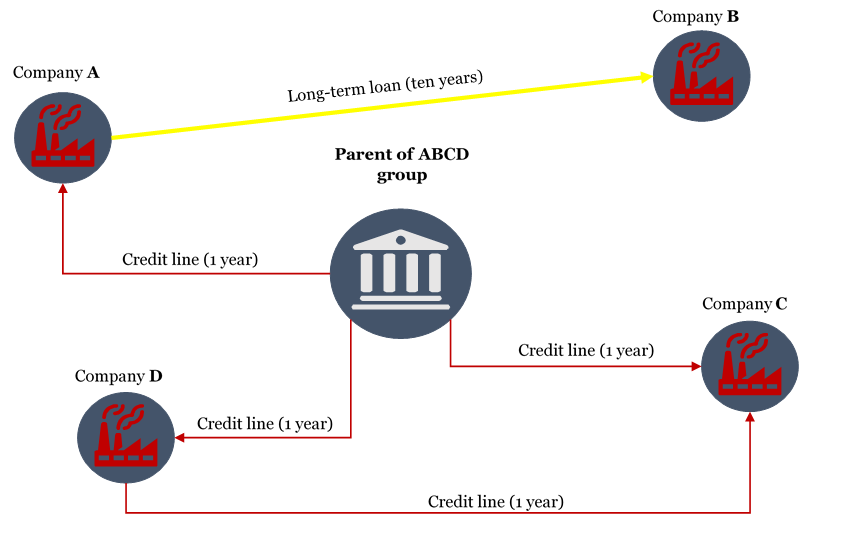

- Group financing policy. The guidelines again emphasise that the intragroup financing policy should be aligned with its external financing policy, and the approach to group financing transactions should be consistent, or a good reason should be given where the approach is not consistent. An example enclosed with the final version explains the idea quite successfully. Below we offer our interpretation and a picture for the example offered by the guidelines that illustrates intragroup policy for financing current assets:

“Company A within ABCD Group makes a ten-year loan to related company B (also within this group), who plans to use the loan for financing its working capital. The finance raised from company A is company B’s sole borrowing. The intragroup financing policy and practice suggest that one-year revolving credit facilities are used to finance intragroup working capital. Accurately defining the financing transaction according to the facts and circumstances (ABCD Group’s financing policy) would lead to the conclusion that an uncontrolled company contemplating a comparable transaction to finance its working capital would have opted for a one-year revolving credit facility, which should then be considered a correct definition of the financing transaction between companies A and B. Company B will retain the need for working capital, so accurately defining the transaction would result in taking the TP approach designed for a revolving credit facility, not a long-term loan.”

- Risk-free return and risk-adjusted return. A risk-free return is appropriate for transactions in which the lender does not perform any essential functions and is restricted in making decisions and controlling risks associated with investment, i.e. in transactions where the lender is a so-called cash box. A lender who assumes and controls the financial risk associated with providing funds, the operational risk associated with using funds, and any other related risks, is entitled to a risk-adjusted return appropriate for his risks and functions.

In the next article of this series, we will explore the remaining key factors to be considered in analysing related-party transactions. We will also offer our thoughts about the recommendations made by the OECD guidelines.