Liga Dobre-Jakubone

Manager, Transfer Pricing, PwC Latvia

Zane Smutova

Senior Manager, Transfer Pricing, PwC Latvia

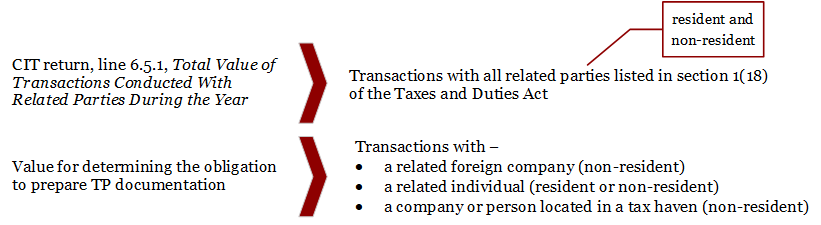

We have written before about significant differences in measuring total transactions made with related parties during the financial year, to be reported on line 6.5.1 of the corporate income tax (CIT) return, and controlled transactions that determine whether the taxpayer becomes liable to prepare and file transfer pricing (TP) documentation with the State Revenue Service (SRS).

So far, it was not clear how the taxpayer was to meet the obligation to report the total value on line 6.5.1 of the CIT return and, more importantly, how the SRS could use that information in practice.

This may be the reason why new requirements have been introduced for reporting the total value of related-party transactions on the CIT return, which could provide significant support to the SRS in assessing the taxpayer’s obligation to prepare and file TP documentation, or the need to launch some tax control on the taxpayer.

Previous requirements

In measuring the total value of transactions1 to go on line 6.5.1 of the CIT return and the value of controlled transactions to be taken into account when determining the obligation to prepare TP documentation, there was a significant difference around exactly what related-party transactions the taxpayer was expected to add up in each case:

This could result in two completely different amounts being computed. Thus, as stated above, it was not clear how the taxpayer was to meet the obligation to report his total related-party transactions for the year on line 6.5.1 of the CIT return.

Current requirements

In view of this, the SRS has probably taken a step forward and from 1 December 2021 the SRS Electronic Declaration System shows the CIT return template for the last tax period of the financial year with the following changes:

- The taxpayer is now required to separately report his transactions with resident and non-resident related parties.

- The title of line 6.5.1 “Total value of transactions made with related parties during the financial year” has been changed to “Total value of transactions made with non-resident related parties during the financial year.”

- There is line 6.5.2 titled “Total value of transactions made with resident related parties during the financial year.”

We note, however, that this amendment to the CIT return is unlikely to provide the SRS with any significant support in assessing the taxpayer’s obligation to prepare and file TP documentation because there are certain discrepancies, for instance, around transactions with related individuals, who may be either resident or non-resident.

Our experience suggests that taxpayers sometimes forget about their obligation to report their total controlled transactions on the CIT return. We strongly recommend meeting this requirement because it may serve as an extra tool helping the taxpayer demonstrate that he has verified his TP compliance. Remember also that the CIT return is open to TP adjustments for five years.

______________________

1 Total related-party transactions, such as sales of goods (income received) plus services received (expenses incurred) and financing transactions (loans received and interest paid)