Vita Sakne

Director, Tax, PwC Latvia

Viktorija Volta

Manager, Tax, PwC Latvia

This article explores hybrid mismatches, ways of identifying them, and a few practical aspects.

Hybrid mismatches are defined under section 7.1 of the Latvian Corporate Income Tax Act, passed on the basis of ATAD I & II directives (Council Directive (EU) 2016/1164 and Council Directive (EU) 2017/952).

Hybrid mismatches are basically differences in how a company or an instrument is taxed under the laws of two or more countries. An identified mismatch is eliminated by denying a deduction or by adding the amount to taxable income. The hybrid mismatch rules aim to prevent companies from exploiting differences in national laws for tax avoidance purposes or to claim benefits available under a double tax treaty.

Types of hybrid mismatches

The first type is deductions or non-inclusion payments that are deductible under the payer country’s rules and are not included in the payer’s ordinary income. This mismatch usually arises if a payment or any part of it is treated as tax-deductible in one country and is not included in the tax base in the other country.

The second type is double-deduction payments, which create two deductions on one and the same payment in two countries (e.g. equipment leased from a foreign company is depreciated in both the lessee country and the lessor country).

The third type is indirect deductions or non-inclusion payments that are deductible under the payer country’s rules and included by the payee as a deduction according to the hybrid mismatch.

Practical examples

Example 1

A company incorporated in the Netherlands makes a loan to a related company incorporated in Latvia. Interest charges are agreed to represent a portion of profit (the so-called profit participating loan). The Latvian company pays interest in 2021 based on the profit reported in its financial statements for 2020. The Latvian company treats the payment as interest and recognises it in its books accordingly. The Dutch company treats the payment received as a dividend and does not include it in its taxable income under Dutch law.

This transaction can create a hybrid mismatch because the Dutch company perceives the Latvian company’s payment as a dividend and therefore exempt, while the Latvian company views it as interest and thus deductible. This is a structured arrangement that results in a deduction without inclusion and should be considered in terms of hybrid mismatches.

Example 2

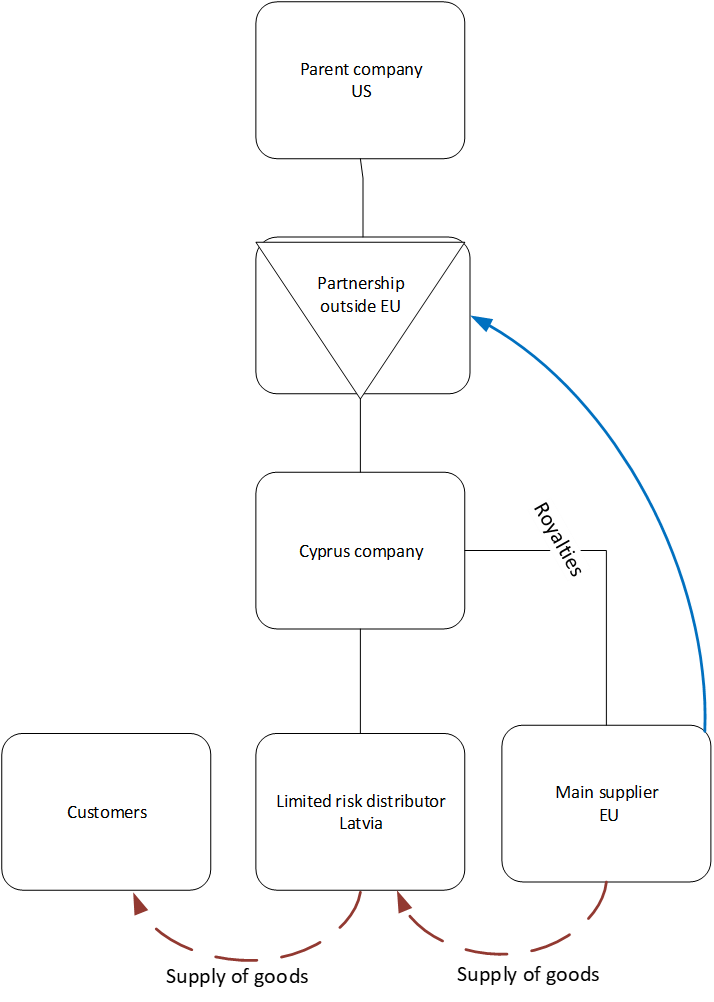

The hybrid mismatch rules can also apply to limited-risk distributor structures.

The distributor pays the main supplier a full fee for the goods, including a royalty for the use of intellectual property. The main supplier pays it on to a partnership registered outside the EU (in Bermuda).

In this situation the Latvian distributor will have to include the royalty in his tax base to eliminate a hybrid mismatch. The Latvian distributor can avoid this obligation by obtaining evidence that the main supplier (an EU company) has already eliminated the hybrid mismatch.