The term “deposit system” is fast becoming a household name. A mandatory deposit system for single-use and reusable drinks packaging became operational on 1 February 2022 in an attempt to prevent environmental pollution. The new deposit system applies to all beverage retailers and their outlets, filling stations, public catering companies selling bottled drinks etc. This article explores the accounting treatment for a retailer who is required to install a deposit system collection point close to his outlet.

The term “deposit system” means a number of actions such as collecting drinks deposit waste packaging from the end user, sorting, transporting, storing, recycling or preparing for re-use according to the original purpose, as well as planning and organising these actions.

The criteria for persons required to install deposit collection points are very important.

If a retailer’s shopping space equals or exceeds 300 square metres in state cities or 60 sq.m in other administrative areas, he is required to collect from end users all types of waste packaging at or near the point of sale but no more than 150 metres away from the retail outlet, and to enter into contracts with the deposit packaging operator (“DPO”). Established in 2020, DPO is an association of experienced Baltic market leaders in the drinks production sector and local small and medium beverage producers. DPO is building a modern and centralised deposit system that will follow the principle of producer responsibility and ensure that proceeds from the recycling of collected materials remain within the deposit system as part of payment for its operating costs.

A retailer whose shopping space does not exceed these criteria is permitted to sell drinks in packaging and refuse to collect waste packaging from the end user.

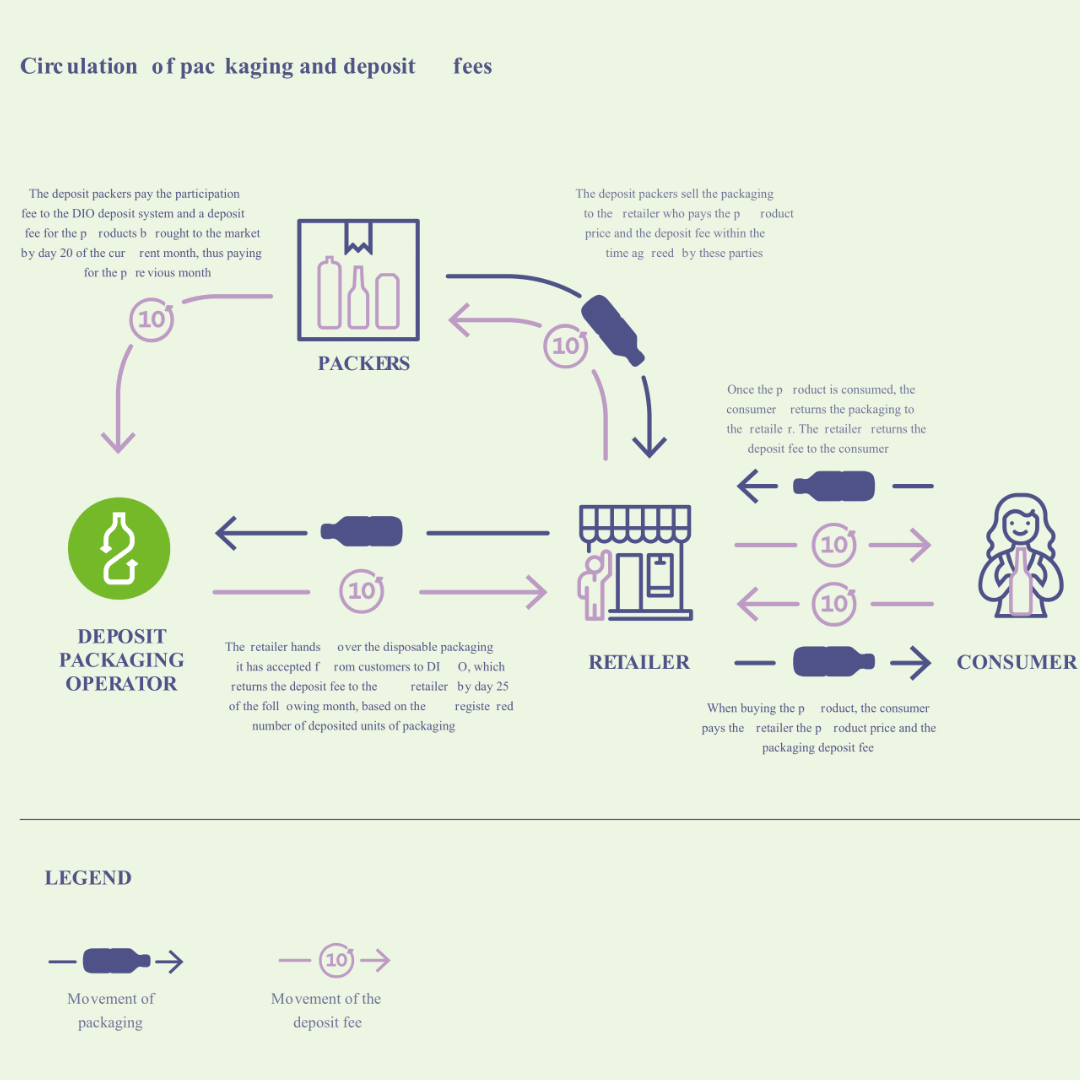

Source: depozitapunkts.lv.

The diagram shows that a retailer has the following main responsibilities in this process:

It is also possible for DPO to agree with the producer and the retailer that the producer pays the retailer directly for managing reusable packaging. In that case the producer pays the deposit charge and the management fee for the reusable packaging deposit directly to the retailer for all reusable packaging that was managed and passed to the producer in the previous month.

DPO determines single-use and reusable packaging management fees (EUR per unit of packaging) for each type of material in each packaging and differentiates costs according to how packaging is collected (automated or manual) and the amount of collected deposit packaging in the following groups:

A management fee is valid for two years after DPO’s decision. DPO posts details of the current deposit packaging management fees on its website.

Below are the accounts to be used on the balance sheet when making entries for the deposit system:

Once goods are received in packaging from the producer, a deposit charge is recorded according to the supporting document:

D Deposit charge EUR 50

K Trade creditors EUR 50

Once goods are sold to the end user, the deposit charge is received:

D Cash EUR 50

K Deposit charge EUR 50

Waste packaging is collected:

D Deposit charge EUR 40

K Payments for vouchers or Cash EUR 40

The deposit charge is refunded when the packaging is transferred within the deposit system:

D Payments for vouchers EUR 40

K Cash or Net revenue EUR 40

Packaging is delivered to DPO or the producer

D Trade debtors 40 (400 pcs * EUR 0.10)

K Deposit charge EUR 40

A management fee is charged:

D Trade debtors EUR 8.92 (400 pcs * EUR 0.0223)

K Operating revenue EUR 7.37

K VAT EUR 1.55

Retailers’ participation in the deposit system is key because it is the retailer who ensures the efficient movement of deposit packaging by selling goods in deposit packaging, receiving the deposit charge, taking back the deposit packaging, and refunding the deposit payments to the end users.

If you have any comments on this article please email them to lv_mindlink@pwc.com

Ask questionThe preparation of annual accounts is relevant to each company, and this process often involves making multiple changes that have a direct effect on the numerical information presented in the company’s financial statements. Accounting software mostly ensures automatic preparation of the balance sheet and the profit and loss account, yet companies, depending on their size, may have to produce a number of notes that tend to take a long time to prepare. In this article we share recommendations for accelerating the technical preparation of financial statements.

Today, cryptocurrency is almost a household word. “Crypto” denotes encryption provided in all modern digital currencies. Cryptocurrencies such as Bitcoin and Dogecoin have a value because people buy them for a price. The cryptocurrency can then be exchanged for goods, services or currencies issued by governments, such as the euro. This article explains how cryptocurrency trades should be booked by a company acting as broker between an individual or entity wishing to buy cryptocurrency or exchange it for money and the stock exchange where it can be bought.

The Accounting Act and the Cabinet of Ministers’ Rule No. 877 came into force on 1 January 2022. Because no transition period is allowed for the new requirements, this article again highlights key changes affecting the CEO’s duties and responsibility for adopting control system rules that must be described in the company’s accounting policy.

We use cookies to make our site work well for you and so we can continually improve it. The cookies that keep the site functioning are always on. We use analytics and marketing cookies to help us understand what content is of most interest and to personalise your user experience.

It’s your choice to accept these or not. You can either click the 'I accept all’ button below or use the switches to choose and save your choices.

For detailed information on how we use cookies and other tracking technologies, please visit our cookies information page.

These cookies are necessary for the website to operate. Our website cannot function without these cookies and they can only be disabled by changing your browser preferences.

These cookies allow us to measure and report on website activity by tracking page visits, visitor locations and how visitors move around the site. The information collected does not directly identify visitors. We drop these cookies and use Adobe to help us analyse the data.

These cookies help us provide you with personalised and relevant services or advertising, and track the effectiveness of our digital marketing activities.