Zane Smutova

Senior Manager, Transfer Pricing, PwC Latvia

Under Latvian transfer pricing (TP) rules, a taxpayer reaching a statutory threshold for controlled transactions must prepare and file TP documentation with the State Revenue Service (SRS) within 12 months after the end of the financial year. The SRS has recently issued a crucial interpretation stating that the acquisition and disposal of assets includes acquiring shares in another company and is therefore considered a transaction for TP purposes.

Share acquisitions and disposals

The tight requirements for preparing and filing TP documentation have raised a crucial question of whether share acquisitions and disposals with related parties specified by sections 1(18) and 15.2(2) of the Taxes and Duties Act are controlled transactions, and if so, then how their value should be measured.

PwC asked the SRS to provide a theoretical interpretation of how a controlled transaction should be identified and disclosed in TP documentation for share acquisitions and disposals. The SRS replied that a transaction under section 1(11) of the Taxes and Duties Act is a step taken to establish, amend, continue or terminate a legal relationship. And the acquisition and disposal of assets includes acquiring shares in another entity to promote the company’s business (including to receive dividends) by creating a long-term relationship with another entity. Based on this, the SRS states that the acquisition and disposal of shares is considered a transaction for TP purposes.

Disclosure in TP documentation

This SRS interpretation provides a key insight that the value of related-party share acquisitions and disposals should be added to the value of controlled transactions (VOCT) for the following reasons:

- The acquisition and disposal of shares is considered a separate transaction resulting in a profit or loss;

- The share acquisition and disposal with any of the related parties specified by the Taxes and Duties Act is considered a controlled transaction;

- Section 15.2 of the Taxes and Duties Act is silent about preconditions for linking the date of the transaction with any resulting revenues or expenses to be disclosed in the income statement.

Accordingly, controlled transactions must be disclosed in TP documentation for the financial year in which they occurred, i.e. the year of acquisition of rights to shares in another company.

An example

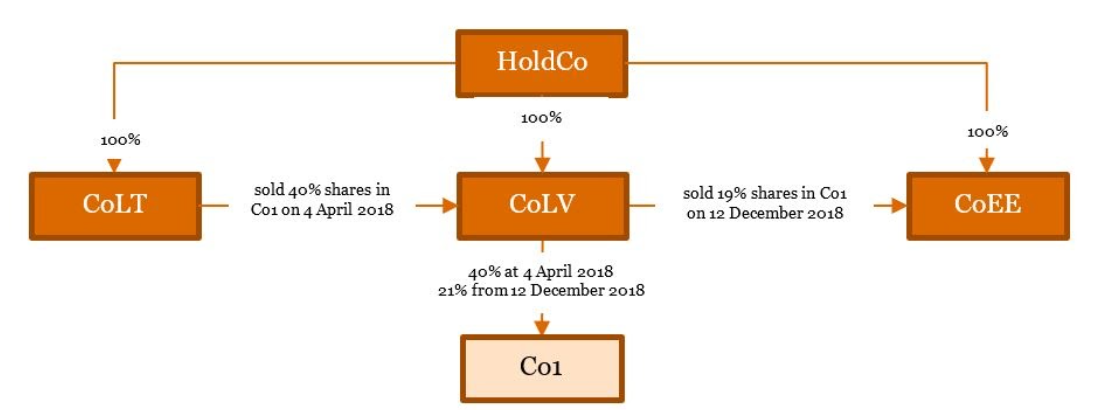

In 2018, a Latvian company (CoLV) and a related party that is considered a related foreign company under the Taxes and Duties Act mutually bought and sold goods for 4,950,000 euros. CoLV acquired shares in Co1 from related Lithuanian company CoLT for 40,000 euros on 4 April 2018. CoLV made a strategic decision to sell shares in Co1 to related Estonian company CoEE for 17,000 euros on 12 December 2018:

To find out whether CoLV must prepare and submit to the SRS a master file or a local file, the company needs to assess all its controlled transactions, including share acquisitions and disposals. Accordingly, to measure CoLV’s total VOCT in 2018, the value of controlled share acquisitions and disposals should be added to the value of controlled purchases and sales of goods:

VOCT = 4,950,000 + 40,000 + 17,000 = 5,007,000 euros

As the VOCT exceeds the threshold prescribed by section 15.2 of the Taxes and Duties Act, CoLV must, within 12 months after the end of the financial year 2018, prepare and submit to the SRS a local file showing that the transaction price (value) is arm’s length in CoLV’s transactions with a related party that is considered a related foreign company under the Taxes and Duties Act.

The local file for share dealings must include information only about the acquisition. The disposal does not exceed 20,000 euros, so CoLV may treat it as immaterial and omit its details from the TP documentation.

We note that a transaction analysis must include all the information specified by the Cabinet of Ministers’ Regulation No. 802 of 18 December 2018, Transfer pricing documentation and procedures for an advance pricing agreement between the taxpayer and the tax authority for a transaction or type of transaction, including detailed functional and economic analyses of each substantial controlled transaction or category.

We also note that this article (and the example) applies only to TP and does not look at any other CIT implications.