Zane Smutova

Senior Manager, Transfer Pricing, PwC Latvia

As the calendar year 2019 is nearing its end, some taxpayers are facing a deadline for filing their transfer pricing (TP) documentation. This article explores the deadline and some technical challenges that are likely to prevent taxpayers from meeting it.

The State Revenue Service’s statistics

An annotation to proposals for amending the Taxes and Duties Act explains that according to the SRS statistics on controlled transactions, the regular TP documentation filing requirement will apply to about 230 companies (including about 100 companies having to submit both a master file and a local file, and about 130 companies having to submit a local file only). The requirement for regularly preparing TP documentation and filing at the SRS request will apply to about 1,000 companies (including about 120 companies having to prepare both a master file and a local file, and about 880 companies having to prepare a local file only).

The magical deadline

Under section 15.2 of the Taxes and Duties Act, a taxpayer is required to prepare TP documentation annually and file within 12 months after the end of the financial period. The annotation provides an example in which a company with its financial period beginning on 1 January 2018 will have to prepare TP documentation by 1 January 2020. However, 1 January is a holiday under section 1 of the Holidays, Remembrance Days and Celebration Days Act.

So a taxpayer may be required to prepare and file TP documentation for the financial year 2018 on or before 2 January 2020 either in hardcopy or via the Electronic Declaration System.

Filing via EDS

A taxpayer’s TP documentation is an important source of information for determining an arm’s length price (value) for their transactions with related parties. Given the taxpayer’s liability for failure to submit TP documentation under the Taxes and Duties Act, even the smallest nuances make a difference, such as filing via EDS. The SRS website says EDS is an easy and secure way to file all tax returns and informational returns as well as applications addressed to the SRS, and EDS is a free service that ensures data security and accuracy, as well as saving time.

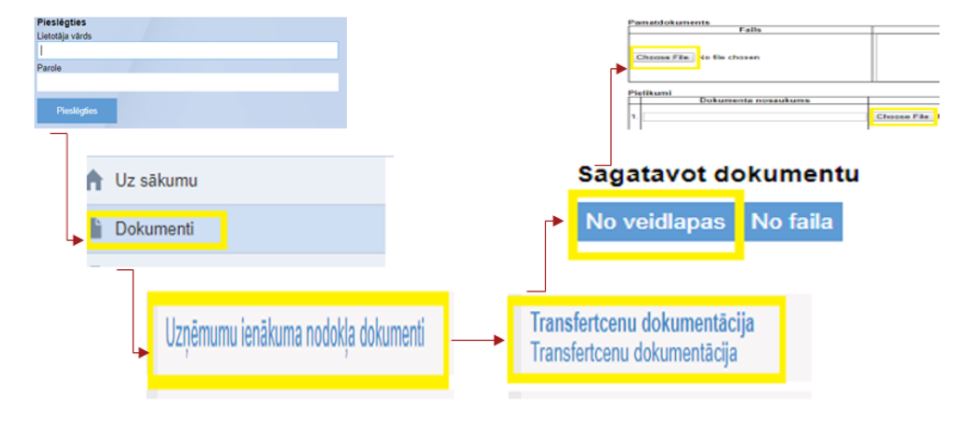

The picture below illustrates the road to filing TP documentation and any related attachments via EDS:

Electronic access to TP documentation

Under section 15.2(13)(2) of the Taxes and Duties Act, a taxpayer is required to ensure that TP documentation is available in an electronic form enabling a text search function.

While EDS might seem to be the easiest and safest way of filing TP documentation, the EDS form presents a few technical limitations:

- The maximum permitted file size is 2.5 MB;

- The maximum permitted total size of all files attached to a document is 5 MB; and

- The maximum permitted number of files to be submitted is four (the principal document plus three attachments).

Based on our experience in preparing TP documentation, the average size of a local file as DOCX (Microsoft Office Word) is 2 MB. Depending on the company’s line of business and the nature of its controlled transactions, as well as how many pictures, charts, illustrations and other visuals are included in the documentation, the file size may well exceed 2.5 MB. Given the technical limitations, an excess will prevent the taxpayer from filing via EDS.

A taxpayer required to submit both a local file and a master file may find submission via EDS to be difficult or even impossible, because a multinational enterprise’s master file, even without any extra attachments, may be twice the file size accepted by EDS.

Possible removal of EDS technical limitations

We have heard that the technical limitations could soon be revised or even cancelled to make it possible for taxpayers to file TP documentation according to Latvian statutory requirements for the format and size of files. The limitations still stand at the time of writing this article. We hope that the responsible authorities will take steps to remove the limitations and enable taxpayers to file TP documentation via EDS.